Elynour Rummyng had a perpetually packed schedule, working 24 hours a day and 7 days a week. She was an alewife, the rare female entrepreneur in 1520s medieval Britain. Her pub, Rummyng’s House, was very much the heart of social life in her Surrey hamlet as everyone back then drank ale, even children! But this did not make Elynour a thriving business-owner. In fact, she became the target of a virulent campaign of defamation. The core of this campaign was a poem written by the poet laureate, John Skelton, who is supposed to have visited Elynour’s establishment. Skelton accused her of adulterating her brews with despicable ingredients like hen’s droppings, of cheating and extorting her customers and most gravely, of witchcraft.

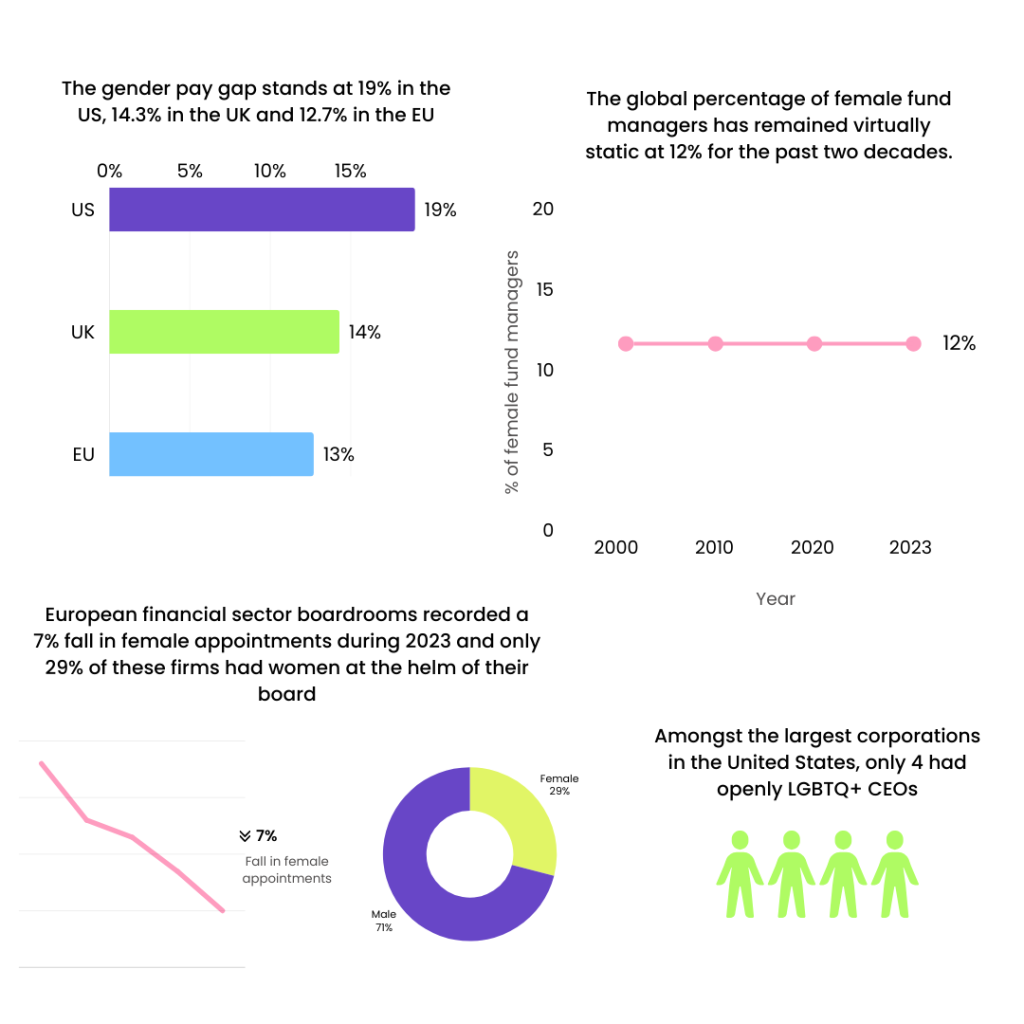

Elynour was not alone in being at the receiving end of such overt vilification. Most female professionals or entrepreneurs of the time were popularly associated with deviancy. It is no wonder that being alewives or “wise-women” (local medical caregivers) never became celebrated or enduring occupations, ultimately dying out in the face of relentless repression. Modern female entrepreneurs and business leaders are no longer accused of being witches or priestesses of Satan. But they continue to face many structural barriers that are equally formidable and have evolved to adapt to 21st century conditions. The following statistics draw a telling picture of the current state of things:

Investors are well-placed to drive change in this landscape, given their influential relationship with companies.

Enter: impact investment

David Spika, the former President and CIO of GuideStone Capital Management, considered impact investing as a means for investors to be “more proactive with their investment dollars” and contribute to “real change across the globe”. Impact investments are investing strategies that seek to create social and environmental change while also generating healthy returns. For instance, between a company that produces AI-driven solutions and one that develops AI-driven assistive technologies, an impact investor is likely to choose the latter.

It is important to stress here that impact investments are not charitable acts. These investments are still made with the purpose of earning maximum profits, but with the additional objective of promoting positive change simultaneously. Therefore, before choosing between the AI solutions company and the AI assistive technologies company, an impact investor will still weigh their return on investment. The primary reason why the latter might be ultimately selected as the company of choice would be the additional social benefits it provides in terms of uplifting persons with disabilities. Impact investments have gained a lot of momentum in recent years.

In fact, out of the 529 environment, social and sustainable (ESG) resolutions filed by shareholders in the US in 2022, 9% addressed gender diversity and gender disparities in company boards and workforce.

Impact investors are also increasingly integrating a gender lens to their portfolios as studies increasingly indicate that gender diverse companies tend to outperform their less-diverse counterparts. Analysts at Morgan Stanley Research examined 1875 companies worldwide to find that firms with greater gender diversity outperformed others by 7.1% in Europe, 3.0% in Japan and 2.0% in North America. Apart from issues surrounding board and workforce representation, gender equity in products and services also present attractive business opportunities. According to a 2021 World Bank report, women constitute 54% of the unbanked population of the world. This opens up a massive market for accessible and inclusive financial services for women that has the potential to be highly profitable.

Global Impact Investing Network (GIIN) underlines two ways in which gender lens investing can be executed. Firstly, by investing in ventures that have women-specific equity goals or values such as:

- Women-owned or women-led companies

- Companies that facilitate greater female participation in the workplace (in their workforce, management, boardrooms and supply chains)

- Companies that produce gender inclusive products and services aimed at improving the lives of women

Secondly, placing gender issues at the centre of investment decisions by:

- Analysing the gender perspective of firms from pre-investment activities (sourcing and due diligence) to post-investment monitoring and evaluation.

- Examining the following aspects of a company:

- Vision or mission to address gender issues

- Organisational structure, culture, internal policies, and workplace environment

- Use of data and metrics to ensure gender-equitable management and initiative to incentivise behavioural change and accountability

- Overall commitment of financial and human resources towards gender equality

While all of this sounds amazing and a step in the right direction on paper, there are some troubling nuances that must be addressed. To find out how gender segregation in entrepreneurial pursuits and entrenched gender roles threaten to throw a wrench in the impact being created by gender-lens investing, read Part 2 of this article.