When investors evaluate a company’s governance, they typically focus on aspects like board composition, audit controls, and compliance checklists. However, there’s a paradox at play: the most significant governance failures often stem not from poor accounting practices but from a detrimental company culture.

Take the cases of Theranos and the Volkswagen emissions scandal, for example. These companies did not collapse due to missing policies; they fell apart because employees didn’t feel safe questioning decisions. In both cases, the pressure to meet targets or please stakeholders overpowered the commitment to ethical conduct, leading day-to-day operations to drift away from core values.

If governance is designed to ensure accountability, transparency, and long-term value, we must begin asking an essential question: what does it feel like to work here?

Culture is not a perk

Governance often invokes thoughts of formalities like board charters and legal disclosures, but it also encompasses the human aspects of decision-making and integrity.

For example, the board of a major UK fashion retailer failed to adequately oversee working conditions. Reports later revealed that employees were being paid below minimum wage and were penalised for basic needs, such as taking water breaks or sick leave, despite having a formal governance structure in place.

Responses from consumers and regulatory bodies to governance shortcomings can result in diminished revenue and considerable harm to a company’s reputation. Information regarding these failures can quickly circulate on social media, and the expectations of regulators are consistently increasing.

Without a foundation of cultural integrity, governance can undermine brand value and threaten business continuity.

Culture as a driver of performance

The data is clear: strong governance supports better financial performance through cultural alignment. Studies show that well-governed companies tend to:

- Make efficient investments

- Generate sustainable cash flow

- Pay consistent dividends

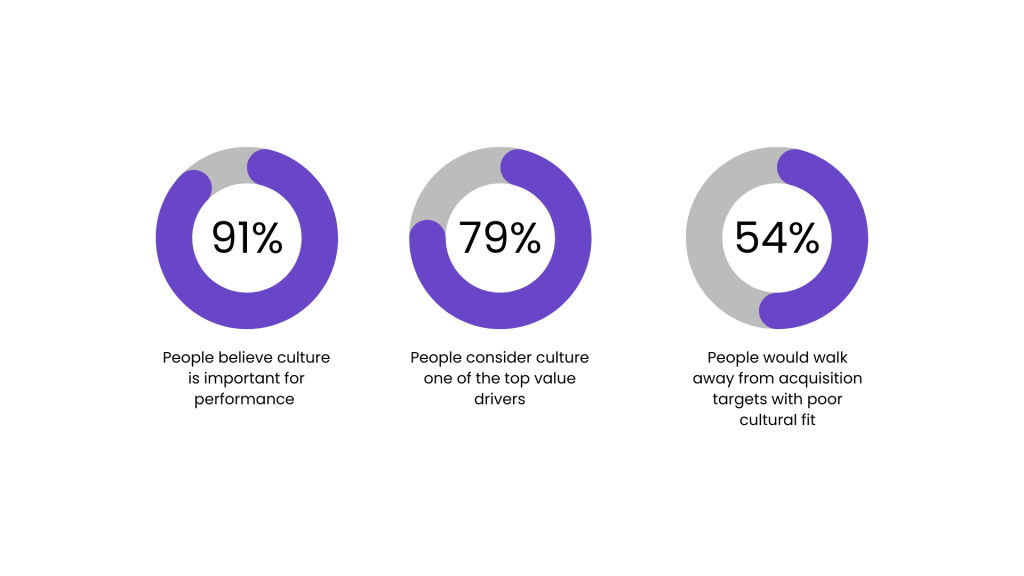

Culture is the force that either strengthens or erodes these capabilities. According to a global survey of executives:

Culture also shapes decisions that formal governance cannot always reach, such as how much risk to take, whether people feel safe to speak up, and what behaviours are normalised. The same survey found that

Executives understand that culture shapes long-term outcomes. Yet nearly 1 in 5 report that their own senior leaders actively undermine cultural effectiveness.

Governance starts with what people feel

We often separate “people issues” from “governance issues”. But culture isn’t soft, it’s shaped by who holds power, whose voices are heard, and which behaviours are rewarded or overlooked.

When boards are disconnected from employees’ real experiences, blind spots are formed. Reporting lines may exist, but if fear outweighs trust, they become ineffective. This is how risk festers and escalates.

That’s why employee experience (especially around inclusion, voice, and psychological safety) must be embedded into governance. It’s not just a reputational issue; it’s a strategic one.

Redefining the ‘G’ in ESG

Going forward, governance must be redefined. It’s not just about rules and oversight, it’s about building a culture rooted in responsibility, transparency, and care.

That means asking more meaningful questions:

- Do leaders hear directly from employees, not just filtered reports?

- Is progress on inclusion and well-being measured and shared transparently?

- Are employee concerns treated with the same urgency as financial risks?

What this means for investors and business leaders

For those leading businesses or making investment decisions, this means asking:

- Does the board receive regular insight into employee sentiment and psychological safety?

- Is whistleblower data tracked for effectiveness—not just compliance?

- Are trust and culture measured with the same discipline as financial KPIs?

When 41% of executives admit they would choose a project that sacrifices long-term value for short-term profitability—unless culture advises against it—it’s evident that culture is a form of governance.

So, if your goal is to reduce risk, boost performance, and future-proof your business, don’t just focus on the governance in ESG. Pay attention to the culture that sustains it.